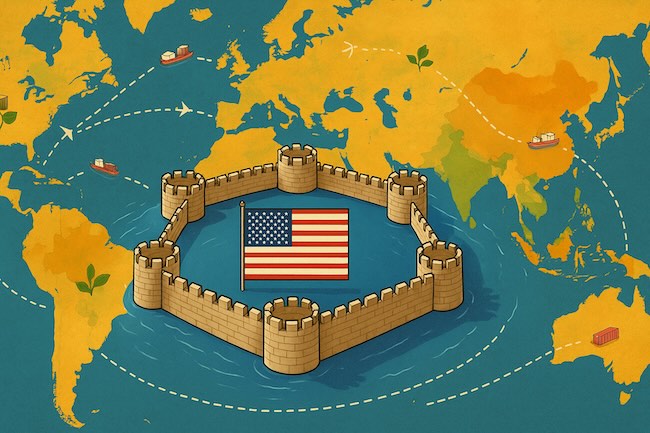

Tariffs and AI Chip Export Restrictions Make the US Lose Tech Centrality

By Tom Kagy | 08 Dec, 2025

Turning itself into a fortress that prioritizes its mindlessly political national security narrative makes the US a poorer, weaker and less secure backwater.

America's tech leadership was built on a simple but powerful formula: attract the world’s smartest minds, give them access to the world’s freest markets, and unleash them under the world’s most innovation-friendly ecosystem.

That formula created Silicon Valley, seeded the global semiconductor industry, established US dominance in software and the internet, and allowed American firms to set standards for everything from personal computing to smartphones to cloud computing and artificial intelligence.

In recent years US policymakers have succumbed to demagoguery and the national security narrative.

Sweeping tariffs on China and other trading partners, coupled with escalating restrictions on advanced chip exports, represent a policy shift driven by an irrational phobia of China fanned by sheer demagoguery. These irrational policies risk undermining the very advantages that put the US at the epicenter of global tech innovation. The combination of tariffs and AI chip export restrictions that will accelerate the rise of foreign competitors—especially China—while weakening the foundations of US tech excellence.

Tariffs Undermine Competitive Drive

Tariffs fundamentally undermines the real drivers of tech competitiveness. Semiconductors, advanced electronics, robotics, and AI development depend on hyper-efficient, globally distributed supply chains. A modern GPU contains tens of thousands of components and subcomponents that may cross international borders dozens of times before arriving at a final assembly line. When tariffs are layered onto these chains, they impose friction, raise costs, and slow down the very industries that rely on speed and scale. Even when the tariffs are targeted at Chinese imports, the penalties often cascade across the entire supply chain, hitting suppliers in Taiwan, South Korea, Vietnam, Malaysia, and Europe that manufacture critical intermediate goods.

The result is a distorted pricing structure that propagates through the supply chain like a tax on innovation. American chip designers—whether in AI, mobile computing, or networking—face higher input costs that ultimately reduce the resources they can devote to R&D. Even more damaging, the uncertainty surrounding future tariffs discourages long-term investments in capacity and infrastructure. Companies cannot allocate billions of dollars to new chip fabs, packaging plants, or data-center expansions if they must constantly hedge against politically driven changes in import costs.

Chip Export Restrictions AHelps China Build a Competing Tech Ecosystem

The second and more strategically damaging trend is the expanding set of export controls on AI chips, chipmaking tools, and advanced compute systems. While these measures aim to slow China’s progress in military AI and high-end computing, they simultaneously create incentives for China and other nations to replicate, replace, and ultimately surpass US-origin technologies. By cutting off access to the most advanced GPUs—such as those produced by Nvidia, AMD, and Intel—the US is pushing China’s tech ecosystem to launch a multi-front national effort to achieve “indigenous substitution” across the entire stack.

History shows the danger of underestimating China’s capacity to mobilize. A decade ago, Beijing announced it would no longer rely on foreign telecommunications infrastructure. Today, Huawei and ZTE dominate huge segments of the global 5G market. When the US blacklisted Huawei from access to Google’s Android services, many analysts predicted Huawei’s smartphone business would collapse. Instead, Huawei has rebuilt enough of its chip production and software ecosystem that it is resurgent in premium phones—powered by domestic 7nm chips produced under heavy US sanctions.

The same dynamic is now underway in AI compute. Chinese firms like Alibaba, Tencent, Baidu, and Huawei have increased investment in domestic AI accelerator designs. The government has funneled massive funding into fabs, EDA software development, lithography toolchains, packaging technologies, and talent recruitment. While China remains years behind in certain areas such as EUV lithography and high-yield advanced node manufacturing, the incentives created by US export controls ensure Beijing will eventually close the gap—at least far enough to become self-sufficient in the compute needed for its domestic AI ambitions.

Ironically, export restrictions may accelerate China’s long-term technical independence while reducing the global market share available to American firms. Nvidia and AMD currently dominate high-end AI compute precisely because they serve the global market. China accounts for 20–25% of the world’s demand for advanced GPUs. Cutting off access to this market does not eliminate the demand—it merely shifts it toward domestic alternatives, even if those alternatives are initially inferior. Over time, scale and iteration can turn small advantages into major ones. By forcing Chinese firms to invest in replacements for US chips, Washington is inadvertently creating the competitors that could someday challenge Nvidia’s dominance.

Losing Tech Talent to More Open Nations

Another unintended consequence is that export restrictions weaken the appeal of US technology ecosystems for global talent. The world’s brightest semiconductor designers, algorithm specialists, and computational scientists flocked to the US because it was the center of global innovation. But when parts of the world are cordoned off from participation, collaboration, and the use of US technology, top researchers may rethink where they can do their best work. Countries like Singapore, Taiwan, South Korea, and Canada are actively courting AI and chip talent by presenting themselves as politically neutral, globally connected hubs. Europe is seeking to revive its semiconductor competitiveness through subsidies and academic partnerships.

Meanwhile, rising anxieties about foreign scientists and engineers in the US, combined with visa restrictions and periodic political rhetoric about “stealing jobs” or “stealing tech,” create an atmosphere of suspicion that discourages the very immigration flows that built Silicon Valley. If the US cannot maintain its advantage in attracting global talent, no amount of tariffs or export controls can compensate.

Tariffs and export restrictions also risk weakening the open, competitive environment that fuels American innovation. Much of the progress in AI—transformer architectures, diffusion models, multimodal systems, and frontier-scale training—came from a globally open research culture in which ideas and breakthroughs flowed across borders and disciplines. Restrictive measures fragment this ecosystem into competing regional blocs. Instead of accelerating US innovation, fragmentation increases duplication, reduces collaboration, and makes it harder to establish shared technical standards. The internet itself was built on open standards; AI and semiconductors may not survive politically driven fragmentation without substantial loss of efficiency.

Protectionism Weakens

Compounding this problem is the political assumption that insulated domestic markets will create more competitive US firms. Historically this idea has almost always failed. Protectionism tends to create weaker companies—companies that become dependent on political shelter instead of competing on global performance. The greatest US tech champions—Microsoft, Apple, Nvidia, Intel, AMD, Qualcomm, Meta, Google, Tesla—did not succeed because the government protected them from foreign competition. They rose to dominance because they competed globally, learned from global markets, hired global talent, and built supply chains spanning continents.

Export restrictions on AI chips may satisfy short-term political goals, but they undermine the long-term learning feedback loops that drive innovation. When US companies lose access to the world’s largest growth markets—China, India, Southeast Asia—they lose insight into how AI is being deployed across billions of users. That loss of visibility slows product evolution. Worse, it opens space for foreign competitors to set their own standards, which the US may eventually be forced to adopt.

Finally, the combination of tariffs and chip export controls may encourage other nations to pursue industrial policies explicitly designed to bypass US technologies. The European Union has already announced efforts to reduce dependence on US cloud providers. Middle Eastern nations are investing heavily in alternative AI training hardware. Japan and South Korea are working to ensure that their semiconductor supply chains cannot be choked by US political decisions. India is building domestic alternatives for cloud, AI, and chip design. The more Washington weaponizes trade and tech dependencies, the more the world is incentivized to develop non-US options.

The United States can maintain its global tech leadership, but not by trying to freeze competitors in place or by restructuring the global supply chain around political goals that contradict economic and technical realities. Leadership requires openness: open markets, open talent paths, open scientific exchange, and open participation in global innovation ecosystems. The American formula that built Silicon Valley still works—but only if the US remembers that power in technology comes from being the place the world wants to join, not the place the world is forced to avoid.

Is a weaker, poorer and more isolated US really more secure? Only when Americans ask the right questions can the US be freed of the kind of isolationist demagoguery that is putting it on a path to fairly rapid decline.

(Image by ChatGPT)

Articles

- US Set to Allow Nvidia H200 GPU Sales to China

- Tariffs and AI Chip Export Restrictions Make the US Lose Tech Centrality

- Declining Consumer Sentiment Increases Rate-Cut Bet

- China Trade Surplus Passes $1 Trillion for First Time on Non-US Surge

- IBM to Buy Cloud Infrastructure Firm Confluent as AI Demand Heats Up

Asian American Success Stories

- The 130 Most Inspiring Asian Americans of All Time

- 12 Most Brilliant Asian Americans

- Greatest Asian American War Heroes

- Asian American Digital Pioneers

- New Asian American Imagemakers

- Asian American Innovators

- The 20 Most Inspiring Asian Sports Stars

- 5 Most Daring Asian Americans

- Surprising Superstars

- TV’s Hottest Asians

- 100 Greatest Asian American Entrepreneurs

- Asian American Wonder Women

- Greatest Asian American Rags-to-Riches Stories

- Notable Asian American Professionals